AI, Digital Assets, and Sustainability: What Form 10-Ks Tell Us About Reporting Trends

We analyzed S&P 500 companies’ SEC Form 10-Ks to understand what leading companies are disclosing about these fast-moving topics and where in the 10-K companies are relaying this information to investors. Our findings show that AI, digital assets, and sustainability-related disclosures have grown or remained strong compared to previous years’ 10-K filings.

It’s critical that companies clearly communicate how these topics are impacting operations, from potential risks to possible financial statements impacts, to foster investor and public trust in their disclosures.

Keep reading for my top takeaways from our 10-K analysis and how auditors can support these evolving disclosures.

Our findings show that AI, digital assets, and sustainability-related disclosures have grown or remained strong compared to previous years’ 10-K filings.

The Rapid Rise of AI Disclosures

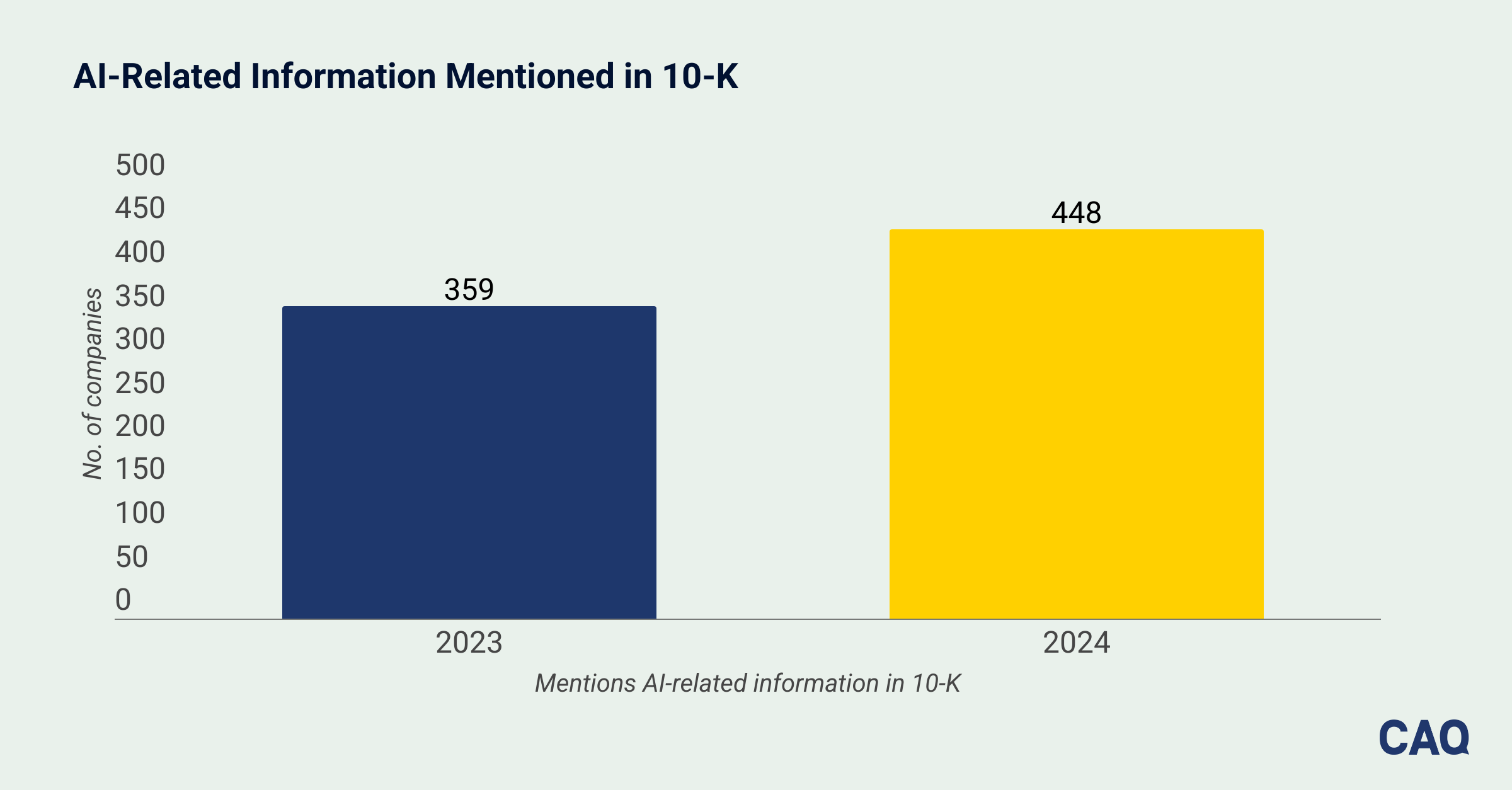

AI is rapidly being integrated into business operations, accelerating the need for companies to disclose how they are using the technology. Our analysis found that 90% of S&P 500 companies (448 companies) mentioned AI-related information in their 2024 10-K – marking a nearly 25% increase from 359 companies in 2023. This growth confirms that transparency in AI is a key focus for management and investors.

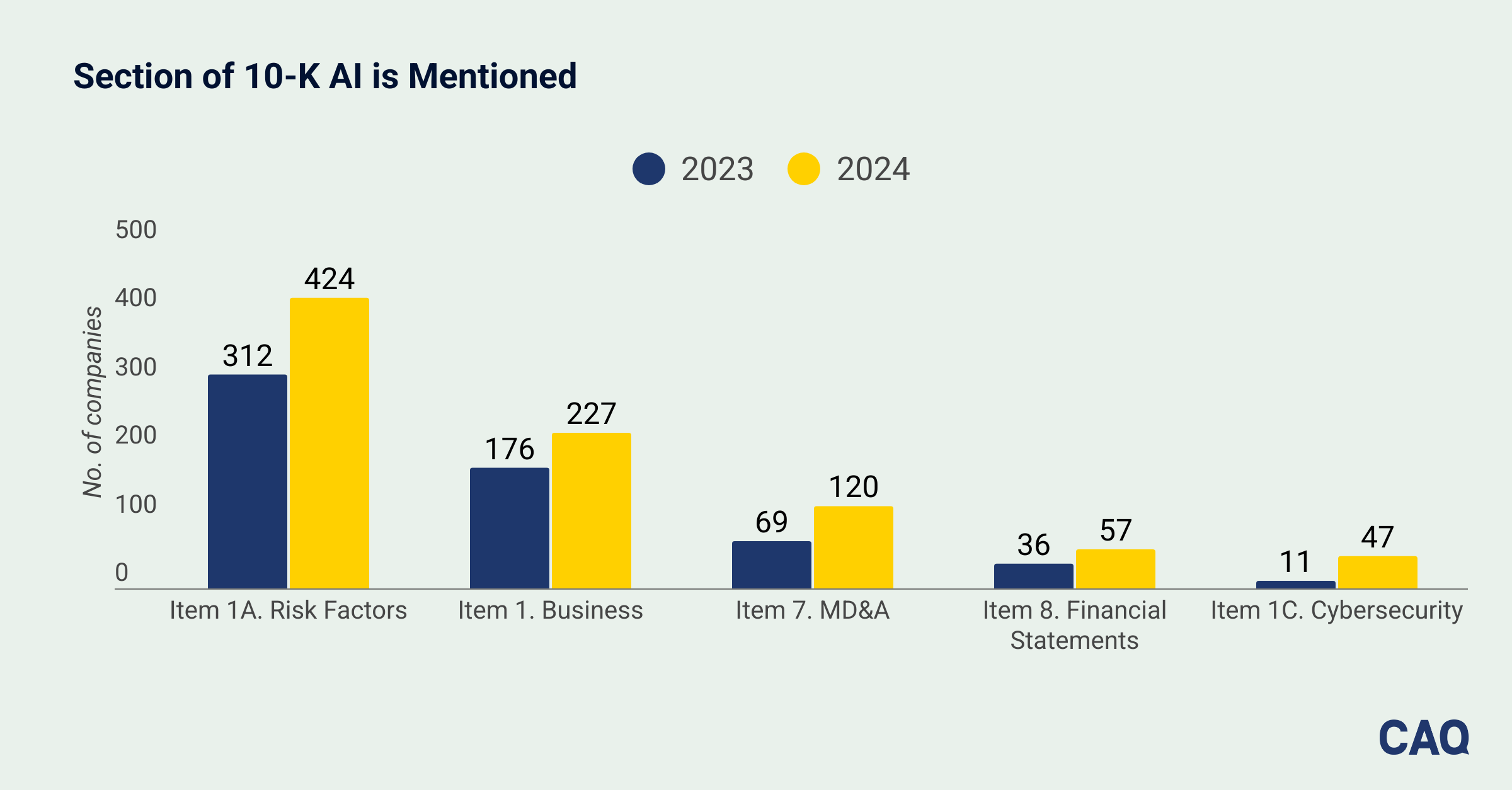

In our analysis, the implications of AI are most frequently cited by companies as part of introducing risks (Item 1A. Risk Factors) of which investors should be aware and business operations and strategy (Item 1. Business) in the 10-K.

Public company auditors can play a key role in enhancing confidence in a company’s governance and controls over AI. There is a clear need for trust in AI, and auditors can help bridge this gap.

We also observed an over 50% increase in AI-related mentions related to the financial statements (Item 8 in the 10-K). Our Institutional Investor Survey found that most investors support the use of AI in the audit process, with 90% saying the technology would increase their trust in the results by improving accuracy and reducing errors. Auditors are utilizing AI to improve the efficiency of audits in an ever-changing economy and will continue upskilling to leverage the technology to its full potential.

We also observed an over 50% increase in AI-related mentions related to the financial statements (Item 8 in the 10-K).

Digital Assets Introduce New Blind Spots

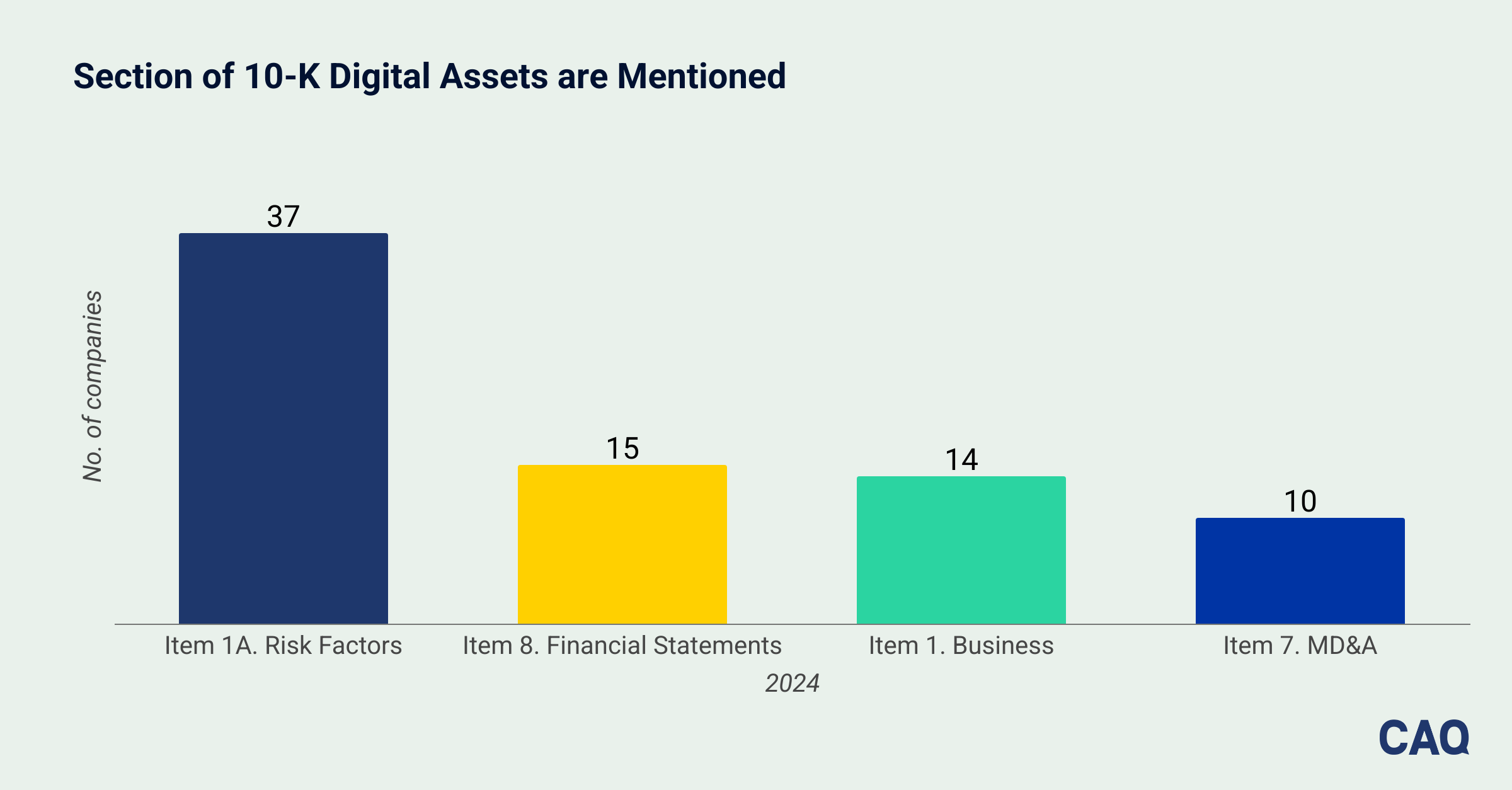

This year, we performed our first-ever analysis of digital asset-related disclosures in S&P 500 companies’ 10-Ks. We observed that only 47 S&P 500 companies, or approximately 9%, mentioned digital asset-related information in their latest 10-K, with most mentions tied to potential areas of risk (Item 1A. Risk Factors).

This aligns with our Fall 2025 Audit Partner Pulse Survey, where 78% of respondents indicated that companies in their primary industry have no exposure to cryptocurrency, and only 6% indicate they’re having conversations with their clients about the potential accounting and reporting implications of the use of cryptocurrency.

The primary risks described in digital assets related disclosures were regulatory uncertainty, market volatility, and technological adaptation costs. Companies specifically noted that the uncertain and evolving nature of the regulatory landscape could lead to costly future compliance. Additionally, the volatility of the digital asset market was highlighted as a risk that could impact companies, whether they are directly or indirectly invested.

While this new technology often promises transparency, as shown in our latest Wall Street Journal article, it does not eliminate risks that lurk in off-chain information and private key management. Auditors can help identify and address these risks and ensure that even in decentralized environments, companies maintain accountability and financial integrity.

The volatility of the digital asset market was highlighted as a risk that could impact companies, whether they are directly or indirectly invested.

Sustainability-Related Disclosures Remain Largely Consistent

The latest S&P 500 companies’ 10-Ks reflect ongoing investor demand for sustainability-related information, with a consistent number of 494 companies disclosing sustainability related information in 2023 and 2024 filings.

Most disclosures continued to relate to potential risks and business operations (Items 1A and 1). Climate-related mentions in financial statements increased by 18% with most mentions continuing to fall within significant accounting policies, commitments and contingencies or litigation, debt or borrowing arrangements, and income taxes.

From 2023 to 2024, there was a roughly 16% decrease in companies that disclosed net zero or carbon neutral commitments and a 5% decrease in companies that mentioned scope 1, 2, or 3, greenhouse gas emissions information in their Form 10-K’s.

We observed that roughly 21% of S&P 500 companies mentioned the European Union Corporate Sustainability Reporting Directive in some way (a 9% increase from the prior year), and 18% mentioned the California Climate Laws (a 3% increase from the prior year), demonstrating that despite the maturity of sustainability-related disclosures, the regulatory landscape demands that leading companies continuously evaluate how evolving disclosure requirements may impact business risks or operations.

From 2023 to 2024, there was a roughly 16% decrease in companies that disclosed net zero or carbon neutral commitments.

The Future of the Profession

A key takeaway from our analysis of 10-Ks is that much of what companies are disclosing about AI, digital assets, and sustainability is largely being disclosed in sections of the 10-K that are not the financial statements. This means that the information is not being audited as part of the financial statement audit. That is because in an audit of the financial statements, the auditor has a limited responsibility for information disclosed in sections of the 10-K that are not the financial statements. Professional standards require the auditors to “read and consider” that information. However, “reading and considering” information involves substantially less work than an audit.

The good news, as CAQ CEO Julie Bell Lindsay recently said at an Axios event, “auditors are not one trick ponies.” As the reliability of information presented outside of the financial statements continues to become more critical to investors, the audit profession stands ready to bring the same trust to this information as they have brought to financial statements for many years. In fact, we see this happening: 73% of S&P 500 companies that report standalone sustainability information already obtain assurance over certain of that information in an assurance engagement that is separate and apart from the audit of the financial statements.

The CAQ will continue to monitor how leading companies are disclosing key information and how auditors can play a role in building trust in this data, and we encourage audit committees and investors to understand how these disclosure trends can support well-informed decisions that shape our economy.

For the latest insights on corporate reporting trends, explore more resources and follow the CAQ on LinkedIn.