Welcome back, Audit Insiders. From the solar eclipse to the worldwide observation of Earth Day, April was a big month for Mother Nature.

It was also a big month for regulators and standard-setters, who issued a spate of proposals, most notably the PCAOB’s proposals on Firm Reporting and Firm and Engagement Metrics. Recent CAQ resources spotlight audit committee and investor insights on a range of reporting topics and we outline considerations for auditors as public companies increasingly use generative AI in financial reporting.

Lastly, I’m featuring a special guest for this month’s Audit Insider. And I had the opportunity to be a guest on the Capital Markets Pulse podcast.

Read on for the latest issues I’m tracking and resources from the profession to assist audit practitioners.

And don’t miss our CPE eligible event today with PwC on tech, talent and the audit committee’s evolving role. More on the event below.

Please note that these perspectives are my own. If this email was forwarded to you, subscribe here so that you never miss a public company auditing update.

We’re closely monitoring these proposals and others from audit regulators and standard setters:

SEC

Climate Rule. After much anticipation, the SEC in March released its long-awaited final climate rule. As expected by many within the public company audit profession, the final rule reflected a streamlined version of the original proposal, though it did retain the requirement for attestation over greenhouse gas (GHG disclosures), requires registrants to disclose the effects of severe weather events and other natural conditions and allowed for flexibility in determining the organizational boundaries used when calculating GHG emissions, among other things. In this blog, my colleague Desirѐ Carroll elaborates on the key differences between the proposal and the final rule.

25th Anniversary of Staff Accounting Bulletin 99 (Materiality). In March, the SEC celebrated a milestone, the anniversary of the Staff Accounting Bulletin (SAB) No. 99, Materiality (Topic 1.M) issued in 1999. The SEC’s Investor Advisory Committee (IAC) held a meeting to discuss the definition of materiality as established by SAB 99. The panelists reflected on SAB 99’s impact and legacy as well as potential challenges around its application. Ultimately, the panelists agreed that the definition has worked as intended with no revisiting necessary.

PCAOB

NOCLAR. In February, the PCAOB reopened the comment period on its proposed auditing standard, AS 2405, A Company’s Noncompliance with Laws and Regulations.

- CAQ take: We were pleased that the PCAOB held a public roundtable and reopened the comment period for NOCLAR given extensive feedback from stakeholders. The CAQ submitted a second comment letter as a supplement to the comment letter we submitted on August 7, 2023. In it, we include additional data and analysis we compiled since the original proposal, potential alternatives to the proposed requirements, our observations from the March 6 roundtable, and our recommendations.

Disclosure of Firm and Engagement Metrics and Modernizing the PCAOB’s Reporting Framework. The PCAOB issued two proposals in April aimed at increasing audit firm transparency, bringing consistency to the disclosure and calculation of audit firm and engagement metrics, and helping the PCAOB conduct its oversight. The first proposal on firm and engagement metrics, if adopted, would require firms to report certain firm and engagement performance metrics to be publicly reported (i.e., available on the PCAOB’s website) on a new form (Form FM for firm-level metrics) and a revised Form AP (for engagement-level metrics for the audits of large accelerated filers (LAFs) and accelerated filers (AFs). The second on firm reporting would, if adopted, enhance reporting of firm financial, governance, and network information; establish timelier and expanded special reporting; and require new disclosures related to cybersecurity and other topics through amendments to Form 2 (annual reporting) and Form 3 (special reporting). Comments to both proposals are due June 7, 2024.

- CAQ take: We have spent over a decade working with auditors and audit committees to better understand the qualitative and quantitative information that enable audit committees and other stakeholders to evaluate audit quality. We encourage issuers and audit committees to share their views with the PCAOB. We have developed this analysis of the PCAOB proposals to assist stakeholders beyond the profession in understanding the proposal. It also provides questions to consider in determining views on the proposals.

Misleading Statements. The PCAOB in February issued a proposal for a new PCAOB Rule 2400, False or Misleading Statements Concerning PCAOB Registration and Oversight. The proposed rule would address how a registered firm and its associated persons present the firm’s PCAOB registration status, including the scope of the PCAOB’s oversight of their work. If adopted, the rule would prohibit false or misleading statements regarding firms’ registration status to clients, potential clients, or the public. The comment period for this proposal closed on April 12, 2024.

Staff Spotlight: Auditing Considerations Related to Commercial Real Estate. The PCAOB released a new staff spotlight that shares considerations for auditors as they plan and conduct audits and reviews of interim financial information in industries with exposure to commercial real estate. The Spotlight, among other things, provides reminders in the following key areas:

- Asset impairment and allowance for credit losses

- Going concern

- Interim review considerations

Staff Spotlight: Root Cause Analysis – An Effective Practice To Drive Audit Quality. The PCAOB released a new staff spotlight that shares observations on how root cause analysis can drive audit quality. The spotlight provides general considerations about the root cause analysis, the PCAOB’s observations of root cause analysis from the inspection process, and key questions for audit firms to consider. It also includes example audit deficiencies where application of root cause analysis could be helpful.

Staff Spotlight: Inspection Observations Related to Auditor Use of Data and Reports. The PCAOB released a new staff spotlight report aimed at improving auditor understanding of how to properly test (1) information produced by the company and (2) information from external sources. The spotlight is spurred by results of the PCAOB’s 2021 and 2022 inspections, which found that 17% of the audits inspected by the PCAOB had deficiencies where the auditor did not perform sufficient procedures to test (or sufficiently test controls over) the accuracy and completeness of IPC or information from external sources.

Chair Williams Delivers Remarks at 2024 Auditing Symposium. Chair Erica Williams recently gave a speech at the 2024 Deloitte/University of Kansas Auditing Symposium where she discussed the work of the PCAOB to modernize auditing standards, enhance inspections, and strengthen enforcement. Chair Williams stated, “We are committed to getting these proposals and every project on our agenda right. And that requires economic analysis from our experts in OERA. Our evidence-based approach starts with understanding the current environment – asking what is needed to ensure investors are best protected and what changes may be needed to achieve that goal. Economic analysis also helps us to see around the corner and anticipate a standard’s impact. Reviewing the work of academics outside the PCAOB is critical to shaping our understanding of the audit and its role in supporting trust in our capital markets.

Public comment is also an essential part of our standard-setting process. And that, too, includes hearing from academics who have been conducting research in these areas and have valuable input to share. We are grateful to everyone who provides feedback, and we carefully weigh and consider each and every comment we receive.” As part of these remarks, she announced a joint conference, The Accounting Review, that will be held in June. She also announced the PCAOB’s annual Conference on Auditing and Capital Markets. If there are academics not on the PCAOB’s listserv who would like to be, please email era@pcaobus.org.

- CAQ take: We are pleased to see Chair Williams talk about the importance of getting their standards right and the role that evidence-based research plays in their standard setting process. We encourage those responding to PCAOB proposals to consider supporting their feedback with research they believe the PCAOB should consider as they finalize their projects.

IASSB

Going Concern Analysis. On April 26, 2023, the International Auditing and Assurance Standards Board (IAASB) issued for public comment an Exposure Draft, proposed International Standard on Auditing (ISA) 570 (Revised 202X), Going Concern. The CAQ conducted an analysis of the 78 comments submitted. Key themes include: there is a need for enhanced coordination with the IASB, there is support for enhanced focus on risk assessment and mixed views on scalability and there is support to explore enhanced transparency but mixed views on proposed “Going Concern” section in the auditor’s report.

Audit Quality

Audit quality in the U.S. remains high, but in light of economic uncertainty, emerging developments, and demands on talent, audit practitioners should remain up to speed on the latest developments impacting audit quality. Read on for recent news, tools, and resources.

Annual Survey of Audit Committees Finds They Are Prioritizing Cybersecurity, Enterprise Risk Management

For several years, the CAQ along with Deloitte’s Center for Board Effectiveness have surveyed audit committee members on what their priorities are and what’s keeping them up at night.

The results? Unsurprisingly, as the risk environment heightens, and likely in response to the SEC’s new disclosure rules, cybersecurity continues to top audit committees’ list of priorities. Sixty-nine percent of respondents highlighted cybersecurity as a top concern in the next 12 months, with 3-in-10 ranking it No. 1. Rounding out No. 2 in their priorities was enterprise risk management (ERM), demonstrating that they remain zeroed in on this core responsibility. Meanwhile, trending topics like artificial intelligence (AI) governance and environmental, social and governance (ESG) reporting are receiving comparably less attention.

The results of the report demonstrate that the scope of the audit committee continues to grow. Download the latest report for full survey results and suggestions for audit committees to increase effectiveness: Audit Committee Practices Report 2024. My colleague, Vanessa Teitelbaum, along with other audit committee members and experts, discussed these findings further in a recent webinar:

The Evolving Role of the Auditor

As investor demand evolves, so does the role of public company auditors. The CAQ is dedicated to providing resources to keep you up-to-date on trending topics in corporate reporting.

Auditing in the Age of Generative AI

While artificial intelligence (AI) and machine learning are not new, generative AI in the form of chat bots and large language models have democratized AI. This technology holds significant promise for public companies as they explore the ways in which AI and genAI can streamline or enhance accounting and financial reporting operations and processes.

A recent CAQ survey found that one in three audit partners see companies in their primary industry sector deploying or planning to deploy AI in their financial reporting process. Given the proliferation of the use of this technology, we developed a resource to help public company auditors understand genAI technology, familiarize themselves with the current regulations around this form of technology and understand considerations and example use cases for public companies using AI.

Download the report: Auditing in the Age of Generative AI.

Investors Support SEC’s Recent Climate Rule According to Survey

With the recent passing of Earth Day and the SEC’s climate rule, climate was in the spotlight in April. While the outcome of ongoing challenges to the rule is yet to be determined, a CAQ survey of institutional investors shows that overall, investors are pleased. According to the survey, 83% of investors in the U.S. support the SEC’s efforts to require climate-related disclosures because of the role such information plays in evaluating investment opportunities. For investors, it seems the issue comes down to trust, with 60% reporting that reliable climate-related disclosures enhance the reputation and trustworthiness of a company.

The same survey found that 94% of investors are clear that they want third-parties to review and assess the climate-related disclosures that companies make. In recognition of Earth Day, my colleague Desirѐ Carroll takes a closer look at the environmental reporting landscape following the SEC’s rule and the important role assurance providers can play.

Talent Spotlight

CAQ Releases Annual Report on Accounting+

The CAQ recently released an annual report for Accounting+, our national campaign and platform focused on raising awareness of an accounting career at the high school and early college levels.

Accounting+ was founded on three key premises. First, to address diversity in the talent pipeline and raise awareness of an accounting career, we prefer a concerted, collective, accounting profession–wide approach over an individualized, fragmented one. Second, we cannot rely on anecdotes and conjectures; data and research must drive our efforts. And third, we must acknowledge that culture change takes time—and having now built the solid foundation for a sustained, multiyear campaign, we are well positioned to achieve our overarching goal of having an accounting profession that looks like the communities in which we live and work.

We are proud to share more about the evolution and impact of Accounting+ in 2023, including how:

- We met students where they were – with 12+ million website visits and 65,000+ new subscribers who opted to learn more about accounting.

- We reached students in the classroom – over 40,000 during the 2022-23 academic year.

- We grew significantly, with a 6% increase in both awareness and interest in accounting.

Download our full 2024 report for more on what Accounting+ has accomplished and what we plan to achieve in the coming year: Accounting+ Annual Report.

PCAOB Board Member George Botic Gives Speech on Talent

I recently read a speech by PCAOB Board Member George Botic to students, where he discussed the important role of the auditing profession to our capital markets. His comment that students are, “entering a vibrant, resilient, and noble profession,” struck me, and I couldn’t agree more.

My own career trajectory has afforded me countless opportunities as well as a sense of purpose and flexibility driven by the chance to play a pivotal role in the success of a business. As this profession faces challenges in attracting the next generation of talent, I hope students can look to the comments of profession leaders like Botic as inspiration to pursue a career in accounting.

In the CAQ’s most recent edition of the Capital Markets Pulse Podcast, I had the opportunity to join our CEO, Julie Bell Lindsay, for a round-robin on the latest headlines impacting the profession, including the SEC’s climate rule, the latest from the PCAOB as well as a personal conversation about the women in my life who have inspired me to pursue a career in accounting.

As a follow-up to that conversation and in preparation for Mother’s Day, I’m featuring a special “Audit Insider” this month. Maybe not so much an auditor, but certainly someone who influenced me to pursue a career in accounting: my mom, Maureen McGowan.

As a follow-up to that conversation and in preparation for Mother’s Day, I’m featuring a special “Audit Insider” this month. Maybe not so much an auditor, but certainly someone who influenced me to pursue a career in accounting: my mom, Maureen McGowan.

Read on for my Q&A with her.

Did you want me to pursue a degree in accounting, or did you see me as entering another profession?

- It was important to me that you pursue a degree in an area that you were interested in, but most importantly would provide you with skills you could translate into a successful career. Your grandfather was an accountant. I had pursued a degree in education but found I preferred a career in the corporate world to being a teacher. While I was not an accountant myself, I worked very closely with accountants throughout my career and was confident this would be an excellent start for you and would offer you many possibilities – and I wasn’t wrong! Almost as important as the degree you pursued was making sure you selected a university that would 1) be a good fit for you and 2) you would graduate in four years with a job. La Salle University and your internships at Fox Chase Cancer Center and PwC helped make this a reality too.

What are your perceptions of the work I do as an auditor? Do you think I do taxes?

- As I mentioned in my previous response, I was fortunate to work alongside accountants throughout my own career in supply chain management. This experience included interacting with my company’s external auditors at times as part of our external audit. As a result, I knew you were not busy because of tax season. That being said – I do think others in our family still thought you did taxes. In reality, I probably have more difficulty describing what you do now and often use your bio on the CAQ’s website to explain to friends and family what you do for work.

If you had to impart one lesson to anyone in life, what would that lesson be?

- If I had to impart one lesson to someone, it would be to not spend too much time worrying about the things you cannot control. As I often told you growing up, “the story is already written, we are living it out.” Focus on the things that are inside your control and let go of the things you can’t control. One experience that tested our family’s ability to let go of the things we couldn’t control was when I donated my kidney to your Uncle Doc. We were devastated as a family when Uncle Doc’s body rejected my kidney. It would have been easy to spend our days angry and mad. I was down a kidney for the rest of my life and Uncle Doc was back on dialysis. While we couldn’t change what happened, we were in control of our outlook, and we chose to remain optimistic that Uncle Doc would soon get a kidney and one that would be a better match than mine. Luckily a year later Uncle Doc received a kidney from the Gift of Life that gave us many more quality years with him.

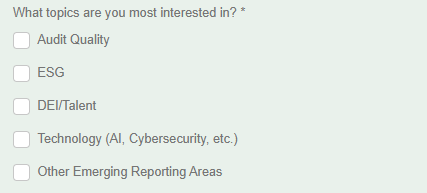

Last month’s poll results are in. Thanks to all who answered; topic requests fell across the board, but this month I’ll follow up on the topic of ESG given the SEC’s most recent climate rule.

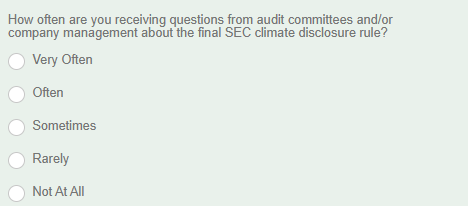

My snap poll question this month (click on the image to take the poll):

I’ll include the answer to this question in next month’s Audit Insider. In the meantime, please continue to let me know what you would like to hear about next month (click on the image to take the poll):

Capital Markets Pulse Episode 5

I had a blast joining our CEO Julie Bell Lindsay in the last edition of the Capital Markets Pulse Podcast. During this round robin, you can get a peek at our thoughts on the latest headlines impacting the profession, including the SEC’s climate rule, the latest from the PCAOB as well as a personal conversation about the women in my life who inspired me to pursue a career in accounting.

Listen to the podcast here: Round Robin with CAQ’s Dennis McGowan.

TODAY: Tech, Talent and the Audit Committee’s Evolving Role

Incorporating technology poses a dual challenge and opportunity for audit committees. As data becomes more abundant and complex, the audit profession faces the critical task of not just analyzing information but deciphering the truth within it.

Join the CAQ and PwC for a 60-minute webcast where we will discuss:

- The role of technology in enhancing audit quality and addressing changing expectations

- Navigating challenges in data analysis and the demand for new expertise

- The changing regulatory agenda and the 2024 PCAOB priorities

- The role of regulators, inspectors, firms, and companies in embracing new technologies

Invited speakers include:

- Christina Ho, PCAOB Board Member

- Kecia Williams Smith, Advisory Group Member and North Carolina A&T State University Associate Professor

- Kimberly Ellison-Taylor, CEO of Ket Solutions LLC and Independent Board Member

- Maria Castanon Moats, PwC Governance Insights Center Leader

- Vanessa Teitelbaum, Professional Practice Senior Director, Center for Audit Quality

This event takes place today at 12:30 p.m. ET and is eligible for 1.0 CPE credit. Join here.

See you next month Audit Insider.

Dennis McGowan

Vice President, Professional Practice and Anti-Fraud Initiatives