Black History Month: A Walk Down Memory Lane in the Accounting Profession

Hello, I’m Kecia Williams Smith, an Associate Professor at North Carolina Agricultural and Technical State University where I lead the Master of Accountancy (MACC) Program and the Center for Accounting Diversity. As a former audit practitioner and regulator, I implement my experiences into innovative academic programming and research related to audit and regulatory communication, audit regulation, auditor judgment and decision-making, and accounting diversity. In my position, I strive to spread awareness and elevate the African American presence within the accounting profession.

As we honor Black History Month, it is my pleasure to spotlight some interesting facts and milestones about diversity in the accounting profession. As we battle a talent shortage in the accounting pipeline, it is more important than ever to consider how we can increase diversity and inclusivity in the profession. To make progress, we must first acknowledge history. Here are a few milestones of interest related to diversity in the accounting profession.

The First HBCU with An Accounting Major

For my history lovers, do you know which Historically Black Colleges and Universities (HBCUs) had the first Accounting major in the country? The answer is Howard University in Washington, DC!

Howard University, also known as “The Mecca”, was truly the mecca for African Americans that were interested in pursuing accounting as a career. Professor Orlando Thornton was on record as teaching accounting courses as early as 1920 before there were any African American CPAs in the country. Although, he never became a CPA, he was instrumental in encouraging students to pursue the credential. Approximately forty years later, in 1963, there were only seven HBCUs that offered accounting programs in the country increasing to 24 schools in 1968. For African Americans seeking to enter the industry, there were limited opportunities available to receive an accounting education, especially in the years following de-segregation. Several HBCUs expanded their degree offerings to include the accounting major. Howard University has continued its legacy of accounting education in the modern era and is one of only three HBCUs to have dual-accreditation for its business school and accounting department.

In 1963, there were only seven HBCUs that offered accounting programs in the country increasing to 24 schools in 1968.

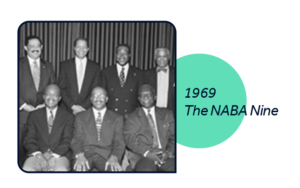

The National Association of Black Accountants

The National Association of Black Accountants (NABA) was founded in December 1969 by nine African-American financial leaders. At the time, there were only 136 African-American Certified Public Accountants (CPAs) out of 100,000 accountants in the country. The leaders originally met to discuss the challenges and limited opportunities they faced in the accounting profession. However, they recognized a lack of an organizational space and subsequently established NABA to address the concerns of Black professionals entering the accounting field. The NABA Nine included the following members:

• Earl Biggett

• Donald Bristow

• Bertram Gibson

• Kenneth Drummond

• Richard McNamee

• Frank Ross

• George Wallace

• Michael Winston

• Ronald Benjamin

Now, NABA Inc. represents more than 200,000 members and provides education, resources, and meaningful career connections to professionals and students in the accounting profession.

The Rise and Fall of the National Association of Minority CPA Firms (NAMCPAF)

Progress in the accounting profession has not always been a straight line. Accounting educational opportunities expanded and minority CPA firms emerged to support a growing need in the African American business community for accounting expertise. Did you know that there was an organization created to facilitate opportunities for minority CPA firms to engage in government operations? Established in 1971, the National Association of Minority CPA Firms was helpful in advancing the business success of smaller African American CPA firms in accessing government opportunities. Smaller African American CPA firms were also critical to individuals attaining their experience requirement needed for CPA licensure.

However, in 1981, Congress, through the Small Business Administration, stopped funding the NAMCPAF. This stoppage negatively affected the firm owners who were looking to sustain and grow their business in a white-dominated profession. This lack of funding resulted in reduced operations and when coupled with limited Small Business Administration support, it sounded the death knell for many small African American CPA firms which in turn impacted their ability to serve smaller African American businesses.

Smaller African American CPA firms were also critical to individuals attaining their experience requirement needed for CPA licensure.

The Impact of the Metcalf Report on the Profession

In 1976, the U.S. Senate Subcommittee on Reports, Accounting, and Management of the Committee on Government Operations chaired by Senator Lee Metcalf released a report on the state of the U.S. accounting profession. This report called into question the structure of the accounting firms and was the first to inquire about the representation of women and minorities in the profession. Of the Big Eight accounting firms, only Ernst and Ernst and Coopers and Lybrand reported having one African American partner each. This critical report also gave way to greater equality for female accountants and in the years followed, the accounting profession saw the elevation of the first African-American female at a firm.

The AICPA Minority Recruitment and Equal Opportunity Committee followed up on The Metcalf Report with a seminar in 1978 to assess the experiences of African Americans in the large CPA firms. Similar to current sentiments by CPA firm staff, the individuals discussed their reduced utilization, lack of communication, and tangential client contact. The lessons from the Metcalf Report are still being learned and implemented today.

Benjamin King: Maryland’s First Black CPA

A native of Washington, DC, Benjamin King received his bachelor’s degree in accounting from Virginia State College in 1949 and served in the Korean War until 1952. While looking for work experience to sit in for the CPA exam in DC, King encountered difficulties from white-owned firms. Upon discovering that Maryland did not have a work requirement for the CPA exam, King moved his family to Seat Pleasant. Shortly after, he passed his CPA exam in 1957 and became the first Black CPA in the state of Maryland and the 54th in the nation.

A native of Washington, DC, Benjamin King received his bachelor’s degree in accounting from Virginia State College in 1949 and served in the Korean War until 1952. While looking for work experience to sit in for the CPA exam in DC, King encountered difficulties from white-owned firms. Upon discovering that Maryland did not have a work requirement for the CPA exam, King moved his family to Seat Pleasant. Shortly after, he passed his CPA exam in 1957 and became the first Black CPA in the state of Maryland and the 54th in the nation.

King eventually established his business in Baltimore, where he became the primary CPA for small, black-owned businesses in the area. He also started his teaching at Morgan State University. In his professorship, he encouraged students to become accountants and either hired or helped them land a position elsewhere after graduation.

Years after his passing, King’s legacy and firm remain as strong as ever, with three of his children running his business and continuing to support young black accountants in Maryland. The continuation of King’s accounting legacy through his children supports research that the CAQ has conducted that found 3 out of 4 accounting majors/minors personally know an accountant, confirming the highly influential role that personal connections play in a students’ future career choice.

King eventually established his business in Baltimore, where he became the primary CPA for small, black-owned businesses in the area.

While there is still work to be done, I am proud of the black leaders in the profession who have paved the way to a more inclusive and diverse workforce. As we look for ways to elevate and increase diversity in the profession this Black History Month and beyond, I encourage you to check out the CAQ’s Bold Ambition as the profession strives to pave the way for a more inclusive, future state of the community.

If you liked this history, learn more by reading A White-Collar Profession: African American Certified Public Accountants since 1921 by Theresa A. Hammond.