Charting the Path to Sustainability: Elevating ESG Reporting this Earth Day

More than ever, sustainability and climate-related risks are top of mind for companies, investors, and everyday Americans. For many investors, the importance of this issue is directly related to a company’s public persona. In a new survey from the CAQ and KRC Research, 60% of institutional investors reported that reliable climate-related disclosures enhance the reputation and trustworthiness of a company. As investors and other stakeholders look to rely on sustainability-related information disclosed by companies, public company auditors are uniquely qualified and prepared to enhance the reliability of such company-prepared information. In fact, according to one study, accountancy firms already perform 58% of global assurance engagements.1

As Senior Director of Professional Practice at the Center for Audit Quality (CAQ), I proudly lead advanced technical and policy-oriented projects to identify, develop, and seek consensus on issues affecting the public company auditing profession, on the topics of ESG reporting and assurance.

While we’re still in the first half of 2024, the Securities and Exchange Commission’s new climate-related disclosure rules have thrown climate reporting into the spotlight. In honor of Earth Day, join me in taking a closer look at the environmental reporting landscape.

Understanding the New SEC Climate Disclosure Rules

In March, the U.S. Securities and Exchange Commission (SEC) voted to adopt its long-awaited climate-related disclosure rules. Here at the CAQ, we support this decision as it will bring more clarity, consistency, and comparability to company-reported climate information and require assurance over certain aspects of the disclosure.

Whether greenhouse gas emissions or the impact of climate issues in company financial statements, audit firms – with their deep understanding of company financial records, operations, business strategies, and internal controls – stand ready to bring their independence and objectivity in providing assurance on this information.

The SEC’s rule is on the minds of investors across the country. According to our recent survey with KRC Research, 83% of institutional investors in the U.S. support the SEC’s efforts to require climate-related disclosures because of the role such information plays in evaluating investment opportunities. We collaborated with the American Institute of Certified Public Accountants (AICPA) and the Chartered Institute of Management Accountants (CIMA) to develop a high-level summary of the rules . A few key changes from the proposal that we observed included:

- Less prescriptive Regulation S-K requirements which provide for certain disclosures based on materiality.

- Regarding Greenhouse gas (GHG) emissions, elimination of Scope 3 GHG emissions disclosure requirements and the exemption of small reporting companies (SRCs), emerging growth companies (EGCs), and non-accelerated filers from the disclosure and attestation requirements.

- Regulation S-X requirements that are narrower in scope. The final rule removed the requirement to evaluate financial statement impacts on a line-item-by-line-item basis for positive and negative impacts of severe weather events, other natural conditions, and transition activities.

- A lengthening of the adoption timeline.

While Scope 3 emissions disclosures were excluded from the final rule, our recent survey with KRC Research suggests that the relevance and importance of Scope 3 will be an ongoing debate. Ninety-one out of 100 institutional investors said that public companies should be required to report their Scope 3 emissions.

I encourage you to check out my in-depth analysis of what we were looking for in the final rules versus what we found as the profession continues to understand its impact. Additionally, Anita Chan, Partner at KPMG US, who played an active role in the development of the proposed rule, also sat down with me to break down the rule. You can watch a replay of that event here.

The Value of Environmental, Social, and Governance (ESG) Information

Here at the CAQ, we know that ESG information is no longer an emerging trend, but a necessary disclosure expected by investors. Comparable and reliable ESG reporting can increase investors’ confidence in the reported information, allowing our capital markets to run smoothly.

The value of ESG reporting is tied to the value of assurance provided by a public company auditor. When it comes to the value of assurance, investors are clear where they stand. In our new survey with KRC, 94% of investors want a third-party to review and assess the climate-related disclosures that companies make. Assurance of climate-related and other company-prepared ESG information is critical, as auditors can enhance the reliability of this information and offer increased investor protection.

The auditing profession has acknowledged the value of ESG information to investors and other market stakeholders and has been working to help the market obtain reliable information on which to base decisions.

When considering assurance needs for climate-related disclosures, investors have additional thoughts. Asked about what assurance provider characteristics enhance their confidence in assurance, institutional investors said that a public company audit firm’s extensive experience diving into business processes and risks (68%) and regulatory oversight that requires them to maintain systems of quality control (60%) are two attributes that give them confidence in the veracity of climate-related disclosures when assured by an auditor. The auditing profession has acknowledged the value of ESG information to investors and other market stakeholders and has been working to help the market obtain reliable information on which to base decisions.

As auditors navigate this evolving landscape, especially after the SEC’s climate disclosure rule, it’s more important than ever that we understand the role of the auditor in climate-related information.

The Rise of ESG

Even before the SEC’s final climate disclosure rule, the CAQ found that growing numbers of public companies were reporting ESG information.

In our 2023 S&P 500 ESG Reporting and Assurance Analysis of the 2021 reporting period, we found that the number of companies reporting ESG information increased from 93% to 99% of S&P 500 companies.

Additionally, most companies have a dedicated ESG page on their corporate investor relations website where the company often discloses ESG information in a standalone PDF report. We also discovered that the number of companies seeking assurance over certain ESG metrics increased by 13% from 2020, and the scope of information subject to assurance also increased.

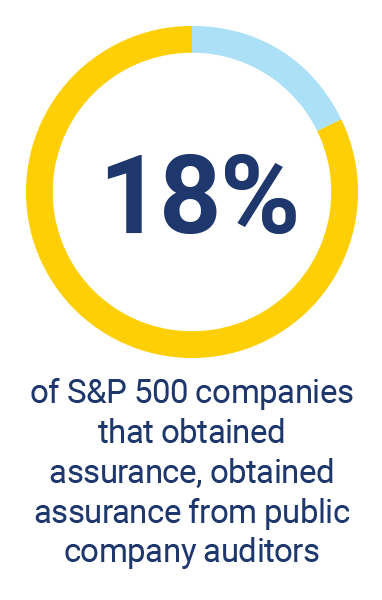

Furthermore, we found that of the S&P 500 companies that obtained assurance over their ESG information, 18% engaged public company auditors to perform their assurance engagements, including leading companies like Alphabet, Nike and Coca-Cola.

Furthermore, we found that of the S&P 500 companies that obtained assurance over their ESG information, 18% engaged public company auditors to perform their assurance engagements, including leading companies like Alphabet, Nike and Coca-Cola.

The conversation around climate-related reporting is ongoing. This Earth Day, as the ESG landscape continues to evolve and our profession responds and adapts, I strongly encourage you to explore the CAQ’s ESG resources to strengthen your understanding and skillset.

The CAQ will continue to release resources to support implementation of the rule and other ESG-related corporate reporting matters over the coming months. Subscribe to stay updated on our latest resources.

Endnotes